Withholding Tax 101 Legally Malaysians. The Inland Revenue Board has issued Public Ruling 112018 - Withholding Tax on Special Classes of Income PR 112018 dated 5 December 2018 replacing the earlierPublic Ruling 12014 - Withholding Tax on Special Classes of Income PR 12014.

Individual Corporate And Trust News From France Withholding Tax France

Objective The objective of this Public Ruling PR is to explain the - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA.

. 112018 including an update of latest tax cases on withholding taxes together with the revised Guidelines on Taxation of Electronic Commerce Transactions issued by the MIRB on 13 May 2019. Paragraph 181 Our comments This position may be challenged by the non-resident. 102019 Withholding Tax on Special Classes of Income Introduction The Inland Revenue Board of Malaysia IRBM has recently released PR.

Agreement signed -1102018 Period of service -112019 - 31122021 Value of contract -RM270000 Due date of payment -Refer to the Schedule. The PR replaces the old PR No. 72019 Taxation of Foreign Fund Management Company.

Public Ruling PR No. Malaysia is now set out in PR 112018. 30 The main criteria that determine whether withholding tax under section 109 or 109B of the Act applies are as follows -.

The Ruling updates and replaces PR No. Preparing For 2019 Malaysian Tax Season Xbrl Training. The employer follows the internal revenue services rules for withholding federal income tax and the.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. INLAND REVENUE BOARD OF MALAYSIA TAX TREATMENT OF ANY SUM RECEIVED AND A DEBT OWING THAT ARISES IN RESPECT OF. 5 December 2018 Page 1 of 39 1.

The new PR comprises the following paragraphs. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. Reimbursements for hotel accommodation in Malaysia are not subject to WHT either.

A Ruling may be withdrawn either wholly or in part by. Https Www2 Deloitte Com Content Dam Deloitte My Documents Tax My Tax Espresso Dec18 Special Alert Public Ruling No 11 2018 Pdf. 12014 of 23 January 2014.

Home Withholding Tax Malaysia Public Ruling 2017 - Https Www Volkswagenag Com Presence Investorrelation Publications Annual Reports 2018 Man Man Gb2017 Eng Pdf - Withholding tax is an amount that employers withhold from an employees paycheck and remit to local and federal taxing authorities. Https Assets Kpmg Content Dam Kpmg Xx Pdf 2018 06 Country Profile Hungary Pdf from Check your tax withholding with the irs tax withholding estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. 122018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

102019 that replaces PR No. Tax code in three decades has occurred cutting individual income tax. Public Ruling No.

19 December 2018 1. The Inland Revenue Board of Malaysia IRBM has issued Public Ruling PR No. PR 112018 essentially incorporates changes to the law since PR 12014 was issued as well.

22 If the non-resident has a PE or a business presence in Malaysia payment received constitutes a business income which is derived from Malaysia and will be taxed under paragraph 4a of the Act. The IRB has published PR No. A Letting of real property as a business source under paragraph 4a of the Income Tax Act 1967 ITA.

Expanded Scope of Withholding Tax and Exemption in 2017 After having expanded the scope of Withholding Tax on 17th January 2017 till 05th September 2017 WHT for technical services was no longer limited to services performed in Malaysia. Example 7 is amended to state that a reimbursement. 112018 which explains the special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA and related withholding rules.

Withholding tax in the DTA between Malaysia and Singapore. 112018 Translation from the. 112018 Withholding Tax on Special Classes of Income Public Ruling No.

Withholding Tax Malaysia Public Ruling 2018 - Https Assets Ey Com Content Dam Ey Sites Ey Com En Gl Topics Tax Tax Pdfs Ey 2018 Global Outlook For Tax Policy Pdf Download. And b Letting of real property as a non-business source under paragraph 4d of the ITA. Changes made to the tax law with the issuance of Public Ruling PR No.

62014 which was published on 4 September 2014 see Tax Alert No. The salient changes in PR 112018 are as follows. Objective This Public Ruling PR explains.

112018 Withholding Tax on Special Classes of Income PR 112018 The Inland Revenue Board of Malaysia IRBM has uploaded on its website the PR 112018 issued on 5 December 2018 which supersedes the previous Public Ruling No. Financing And Leases Tax Treatment Acca Global. The IRB has issued Public Ruling 112018 - Withholding Tax on Special Classes of Income PR 112018 dated 5 December 2018 replacing the earlier Public Ruling 12014 - Withholding Tax on Special Classes of.

The Income Tax Act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non-resident public entertainers to a non-resident person NR payee he shall deduct withholding tax at the prescribed rate from such payment and whether such tax has been deducted or not pay that tax to the Director General. Course Highlights Overview of withholding tax. Taxation of Foreign Fund Management Company dated 3 December 2019.

View PR_2018_11 Withholding Tax On Special Classes Of Incomepdf from AA 1INLAND REVENUE BOARD OF MALAYSIA WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME PUBLIC RULING NO. This new 15-page PR replaces PR No. An employee claims a number of withholding allowances on their w.

WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Http Www Hasil Gov My Pdf Pdfam Pr 1 2014 Pdf. Latest Update on Withholding Tax Treatment on Payments of Service Fees to Non-Residents The Inland Revenue Board of Malaysia IRBM issued Public Ruling 112018 - Withholding Tax on Special Classes of Income PR 112018 on 5 December 2018 which supersedes the earlier PR 12014.

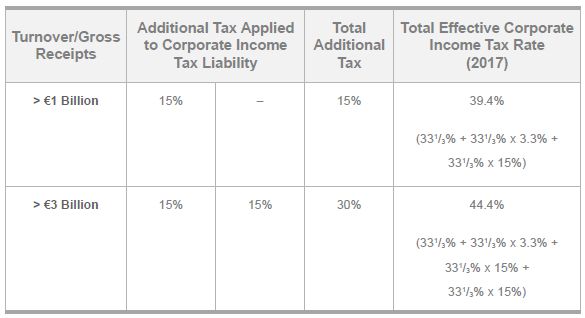

Payments made to non-residents in respect of the provision of any advice assistance or services performed in Malaysia and rental of movable properties are subject to a 10 WHT unless exempted under statutory provisions for purpose of granting incentives. Sources shown in the preceding table.

T1q Introduction 1 Tutorial 1 Introduction To Malaysian Taxation Amp Studocu

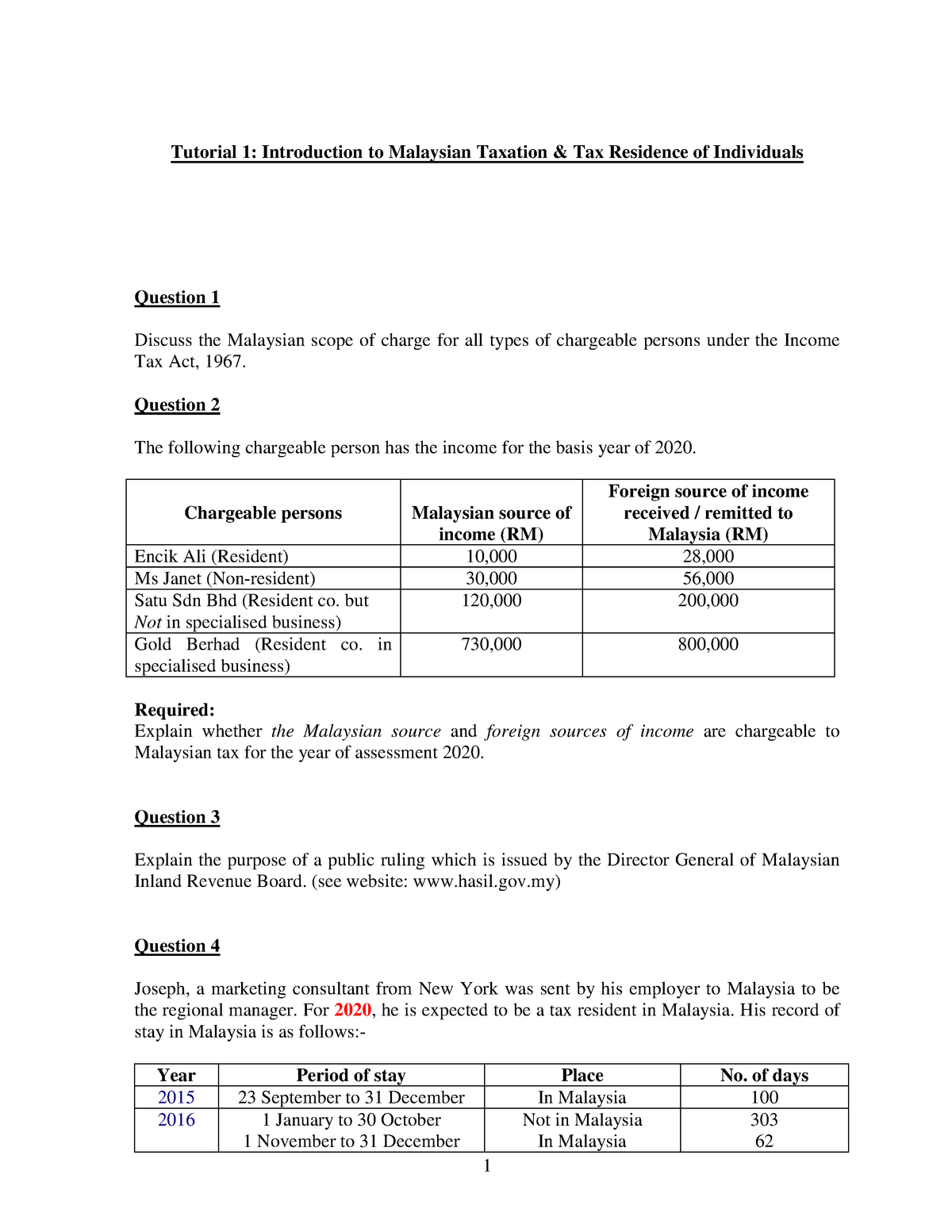

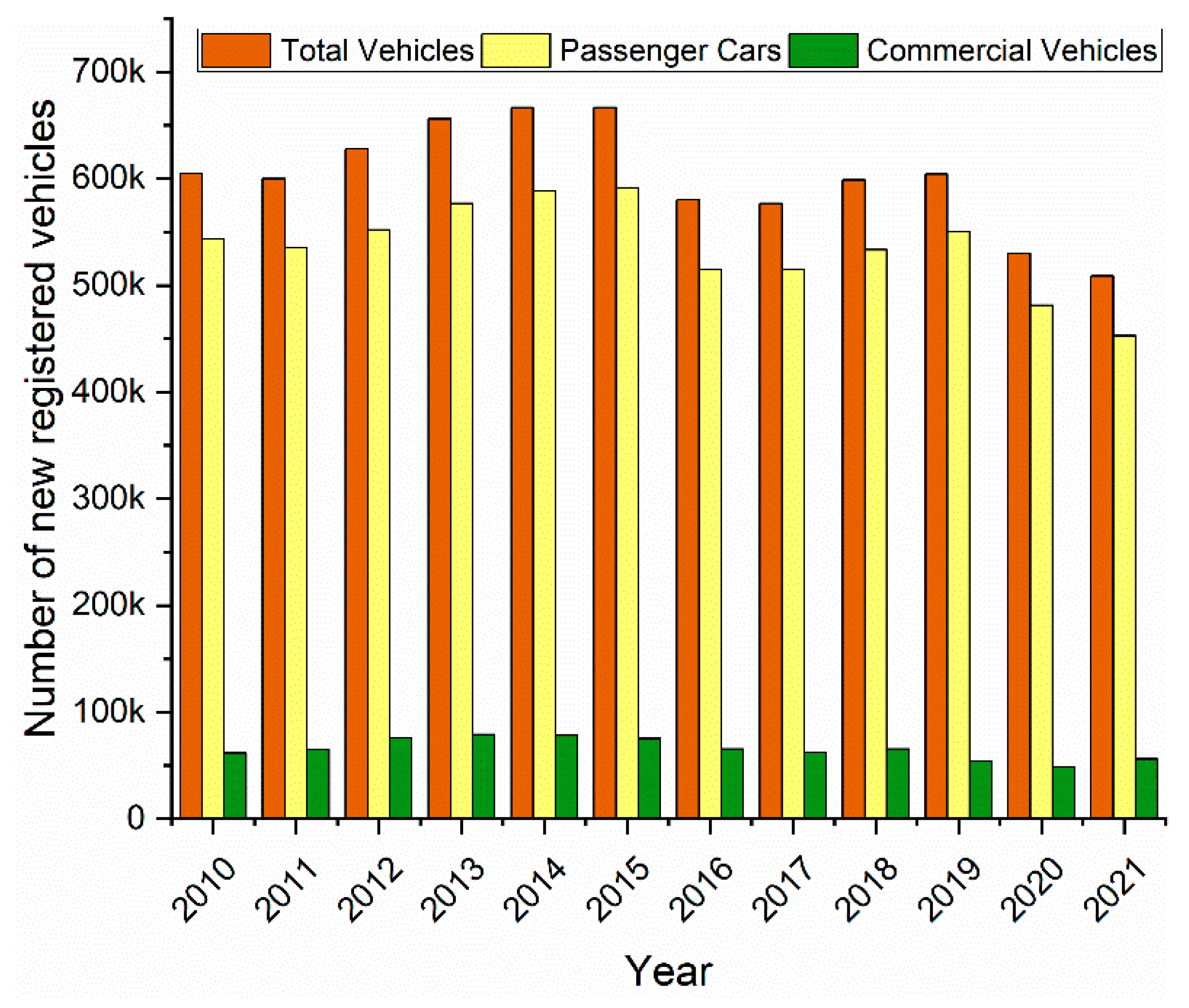

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Sales And Service Tax Act 2018

Evaluation Of The Temporary Foreign Worker Program Canada Ca

Sales And Service Tax Act 2018

Sales And Service Tax Act 2018

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Malaysia Sst Sales And Service Tax A Complete Guide

Sales And Service Tax Act 2018

![]()

Tax Alert Archive Deloitte Canada Tax

Payments That Are Subject To Withholding Tax Wt

Sales And Service Tax Act 2018